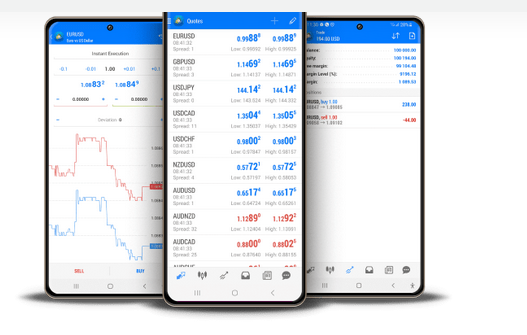

Metatrader 4 Mobile App: Trading at Your Fingertips

Metatrader 4, or MT4, is a well-known electrical forex trading program employed by millions of traders throughout the world. It is readily available for liberated to download which is utilized for investing fiscal equipment like foreign currencies, shares, and items. The MT4 program could be customized, and dealers may use a variety of tools and signs to assist them analyze the market segments. In this comprehensive manual, we shall include everything you should know to learn Metatrader 4.

1. Comprehending the MT4 User interface

The first task to perfecting MT4 is usually to understand its user interface. Whenever you wide open the system, you will see numerous home windows and tabs. The “Market Watch” window displays the various monetary equipment available for forex trading, while the “Navigator” home window displays your account specifics, signals, and expert analysts. The “Terminal” windowpane shows your open trades and your industry historical past. You are able to individualize these home windows by appropriate-hitting them and deciding on “individualize.”

2. Introducing Customized Signals

Signals are the best instruments designed for inspecting the trading markets, and MT4 has a wide range of built in signals. Nonetheless, you may also include your personal custom made signs. To do this, you need to download the indication rule and help save it on the “Indications” directory inside the MT4 listing. After you have done this, you can add the indicator to the graph or chart by simply clicking on “Insert” and after that picking “Indications.”

3. Employing Specialist Analysts

Expert Consultants, or EAs, are computerized forex trading systems that can implement transactions based on predetermined conditions. To make use of an EA, first you need to download or produce one. Upon having performed this, you could add the EA for your graph or chart by simply clicking on “Navigator” after which choosing “Expert Consultants.” Then you can set up the factors for your EA, such as the whole lot sizing, end-decrease, and get-profit degrees.

4. Backtesting Your Method

Before you start forex trading with real cash, it’s vital to backtest your approach. MT4 enables you to try this by utilizing the “Approach Tester” functionality. To utilize the Technique Tester, first you need to select the professional expert you would like to analyze and after that established the parameters for the analyze. Upon having done this, start the exam and see how your strategy could have executed before.

5. Putting Transactions and Handling Risk

When you have backtested your approach and are willing to start off investing with actual money, you must know the way to place transactions and control danger. To position a trade, you need to choose the monetary device you would like to business and then click “New Get.” Then you can set up the good deal dimensions, quit-loss, and take-profit ranges. It’s important to manage your danger by setting proper quit-decrease levels and never taking a chance on a lot more than within your budget to shed.

Bottom line:

In conclusion, learning Metatrader 4 needs being familiar with its user interface, adding customized indicators, utilizing specialist consultants, backtesting your approach, and positioning investments while managing chance. By following the information with this extensive manual, you can be a effective MT4 forex trader. Always training excellent threat administration as well as to show patience, as perfecting MT4 requires effort and time. With devotion and determination, you are able to accomplish amazing success with Metatrader 4. Happy investing!